- Catalyzer X

- Posts

- Palomma

Palomma

Fintech, Financial Services, Mobile Apps, Payments

🌎🌍🌏| South America Tuesday

Modern Payments, for Modern Business.

Problem

Market Potential: Latin America’s e-commerce market presents immense potential for growth and innovation.

Challenge: Online merchants face challenges in reducing card processing fees and improving conversion rates.

Lacking Tool: Existing payment methods lack efficiency, leading to friction in the payment process, hindering conversions.

Extra Barriers: Complications arise with non-recurring payments and reconciliation, adding extra barriers for merchants.

This issue's Startup equips online merchants and apps in Latin America with a solution to streamline payments, allowing customers to pay directly from their bank accounts without friction.

Solution

Palomma

Palomma enables online merchants and apps across Latin America to implement frictionless Pay by Bank payments (A2A), boosting conversion rates and simplifying payment processes.

How: They achieve this through a single API and platform that seamlessly integrates with existing systems.

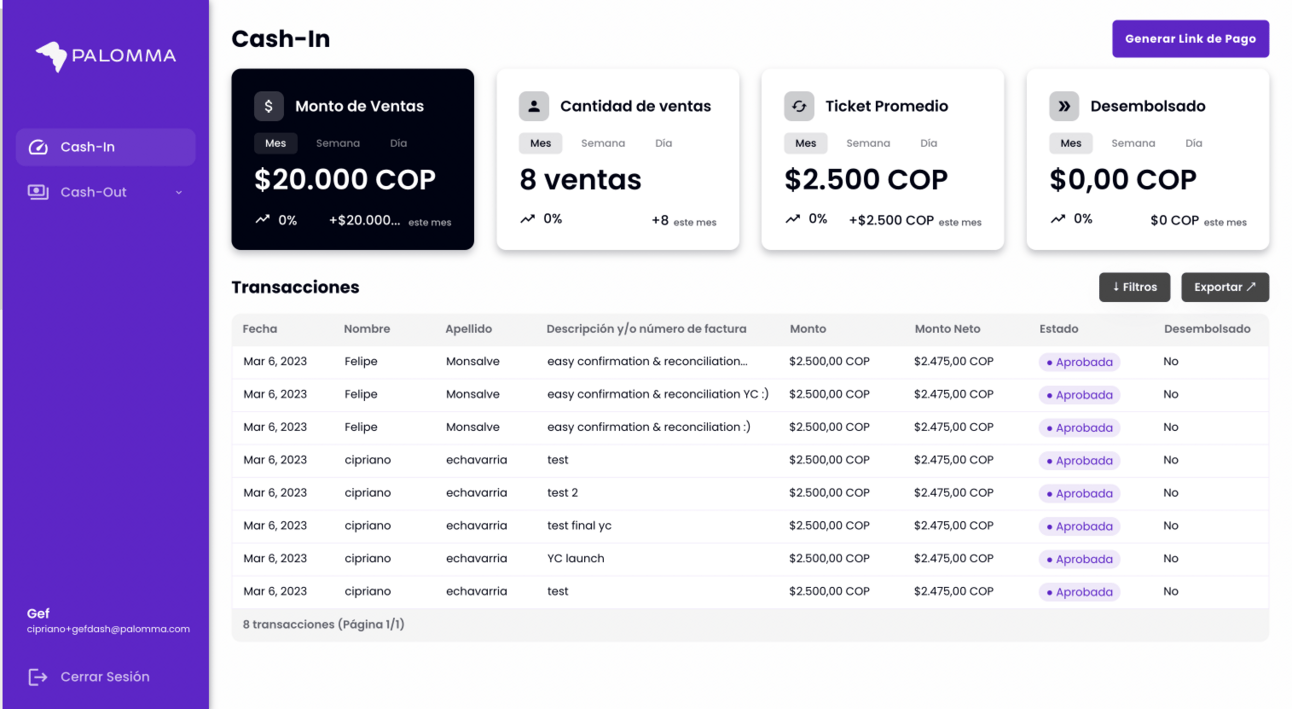

Platform: The platform streamlines the payment process, enabling higher conversion rates and easy reconciliation for merchants.

Target: Targeting online merchants and apps in Latin America, addressing the need for cost-effective and efficient payment solutions.

Resolving: Resolving the challenges associated with high card fees and cumbersome payment methods, benefiting merchants and customers.

Product Demonstration

Company Info

Industry: Fintech, Financial Services, Mobile Apps, Payments

Business Model: Transaction-Based

HQ: Medellín, Antioquia, Colombia

Founding Year: 2023

Employee Count: 1-10

Investors: Y Combinator, Unpopular Ventures, 99 Startups, 77 — by SBXi

Funding Amount: $500.000

Traction

Enabling merchants to save 70-80% on card processing fees

Increasing conversion rates by 30-40% with frictionless Pay by Bank

Simplifying payment reconciliation for merchants

Competition Advantages

Seamless integration with existing merchant systems

Higher conversion rates compared to traditional card payments

Simplified payment reconciliation process

Founders

Cipriano Echavarria, Co-Founder (Experience in Investment Banking at Morgan Stanley, Launching and scaling Nubank's operation in Colombia)

Nicolas Gomez del Campo, Co-Founder (Engineer with experience at JP Morgan in algorithmic trading)

Felipe Monsalve, Technical Co-Founder (Experience at Meta, Bloomberg, and startups in the US and Latin America)

Job Opportunities & Contact

Hiring Status: Active

Contact Information:

WhatsApp: +573146450404

https://www.linkedin.com/company/palomma/

Why Invest by George

Palomma simplifies payments in Latin America like monkey finding banana with one click!

🐵

Voices From Our Community (By George: Coming Soon 🍌)

Enjoyed this edition? Leave a comment, reply, or share on social media for a chance to be featured in our next edition!

Cheers,

Peniel Keme Kitoko

Catalyzer X

Is your Startup perfect for one of our next editions?

Are we the perfect partner to invest, work or advertise with?

Contact us at ‘[email protected]’!